How Long I Can Log in Again After 3 Tmes Wrong Password With Irs

(Last updated: 10.01.2022)

"Don't worry if y'all made a mistake on your tax return or forgot to claim a tax credit or deduction. You can prepare it by filing an amended render." – The IRS

Made an fault on nonresident alien income tax return? Don't worry, fixing it is non equally difficult equally y'all might think!

U.s.a. tax can exist tricky – especially if you're a nonresident who is not familiar with the American revenue enhancement system.

The Internal Acquirement Service (IRS) knows the tax code is complex, and that people brand mistakes.

A tax return can be considered 'incorrect' or 'incomplete' for a variety of different reasons. Elementary things similar forgetting to sign a form, to big issues like misreporting income, or incorrectly calculating a deduction can all touch the validity of a tax render.

While making a mistake on your return is non necessarily a big deal, information technology is of import that you rectify the situation past filing an amended revenue enhancement return, where advisable.

If yous realize that yous made an error on a revenue enhancement return you already filed, or you take come up beyond new data (for example you lot received an additional W-2 or 1042-Due south), simply file an amended tax return to make a correction.

In this article we'll cover:

- When you lot should better your revenue enhancement render;

- When's there's no need to;

- How to meliorate a revenue enhancement return;

- Can I e-file course 1040-X?

- What happens after filing form 1040X

- Timelines for processing

Here are some key things you demand to know in club to correctly re-do your taxes:

When to Meliorate a Revenue enhancement Return That You Filed

When should y'all file an amended tax return?

The first thing you should know is that non all errors crave an amended tax render.

You should amend your tax return if you lot need to:

one. Correct your income and tax figures

If you didn't include all your payment documents when preparing your return, or if you receive additional tax documents for the tax year, you would need to file an amended taxation return to report the additional income and tax.

For example, a Form Westward-2 arrives in the postal service after the taxation deadline, or you forgot to file information technology.

2. Claim all of the allowable tax deductions or tax credits

Yous should also amend your return to merits all of the allowable taxation deductions, or tax credits that yous did not claim when you filed your original return.

In previous years, there were a number of deductions that international students could use to reduce their overall tax liability.

However, in November 2017, President Donald Trump introduced a GOP tax reform bill, which brought widespread tax-related changes for most taxpayers.

three. If yous need to correct your filing status

For example, if you filed every bit single merely actually got married on the terminal 24-hour interval of the tax twelvemonth, you will need to ameliorate your return by filing your taxes under the appropriate status – married filing jointly, or married filing separately (note: nonresidents can file only as married filing separately).

4. Correct the number of dependents you claimed

An amended return volition be needed if a taxpayer wants to merits additional dependents, or has claimed ineligible dependents, and needs to arrange the exemptions amount.

The general IRS rule states that a nonresident conflicting, whether unmarried or married, may claim only one personal exemption, equally long every bit they are non claimed as a dependent on whatever other Usa revenue enhancement return (in which case their personal exemption was already used).

At that place are some exceptions to the full general rule which allow specific groups of taxpayers to claim dependent exemptions for their family members:

- Residents of Canada or United mexican states

- Residents of the Republic of Korea

- Residents of India

5. If you filed the incorrect form for your revenue enhancement return, or yous filed nether the wrong residency status

If you are considered a nonresident for tax purposes in the The states, you lot should file 1040NR, or 1040NR EZ.

If you lot filed form 1040, this ways you filed as a resident and your tax return is incorrect.

NOTE: Keep in listen that near of the online tax filing solutions similar TurboTax and H&R Cake do not support NRA tax returns. If you filed online, most certainly you field as a resident conflicting.

What if I accidentally filed form 1040, instead of Form 1040NR / 1040NR EZ?

Nonresidents who file their tax returns with form 1040 (which is for U.S. citizens and residents) instead of the return for nonresidents (Course 1040NR) may claim credits or accept deductions to which they are not entitled. This means their tax return will be inaccurate and they could get into trouble with the IRS later on. This is another case when you volition demand to amend your tax render.

half-dozen. Yous received the CARES Act stimulus payment and you were not entitled to it

In response to the COVID-nineteen pandemic, the United states government has introduced the CARES (Coronavirus Aid, Relief and Economic Security) Act. The CARES Act provides a number of fiscal supports that tin exist claimed by The states citizens, permanent residents, and residents for tax purposes.Nonresident aliens are not eligible to receive this stimulus.

If you believe that y'all have received this payment in error, information technology is probable that you should file an amended tax return and also render the payment to the IRS (the payment should be sent separately to your amended render). You lot should also send a comprehend annotation with your amended taxation return to outline why you are returning the payment.

Find out more in our guide to navigating the COVID-xix CARES Human action Stimulus checks for nonresidents here.

If you realize that y'all demand to make one or more of the corrections listed above use Form 1040X (Amended U.S. Individual Income Tax Render) to amend the federal income tax return that you lot previously filed.

Need a hand filing your amended revenue enhancement return? Get-go here

Amend my tax render

When Not to Amend a Tax Return That You Filed

In some cases, you don't demand to edit your tax return later on filing.

The IRS usually corrects math errors when processing your original render, without the need for you to file further paperwork.

If y'all didn't include a required class with your return, the IRS will write to you lot to asking the missing item so that they can end processing your tax return.

When you receive a notice about errors, there will usually be other ways to correct errors also an amended taxation render.

Usually, these misunderstandings tin can be chop-chop rectified by providing the correct information to the IRS. The find that y'all receive will explicate conspicuously what the effect is and how to respond.

How do I amend my federal and/or state tax return?

In order to meliorate your taxation return you must:

- File a course 1040X

- Right the errors on your previous tax render

It's important to note that once you have sent off your tax return, you can no longer edit that specific render.

It'southward very important to notation that you lot should not attempt to correct the state of affairs by filing another original Class 1040NR return. That will misfile things further and may cause additional headaches for you. If you lot want to amend your federal tax return, you will need to file aCourse 1040-X, Amended US Individual Income Tax Return, even if you filed your original return only a few days ago.

You won't have to right the entire tax render, only outline the necessary changes and suit your tax liability appropriately.

Your state will use a unique form to amend your tax return (Schedule 10 for California, for example) which you will need to attach to your federal state return.

Below we will testify you how you can hands make full out 1040x tax course online and amend your tax return with Sprintax!

How to amend your taxation return in 4 easy steps using Sprintax Returns

We've also prepared a stride past stride guide to amending your revenue enhancement return with Sprintax:

Footstep 1

To begin the process of amending your tax return, all you demand to do islogin to your Sprintax account (or create ane if you haven't already!).

Pace two

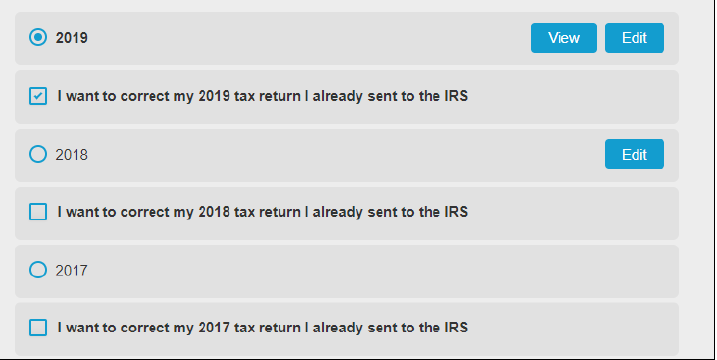

You will be asked to select the taxation year that you would similar to amend. Be certain to tick the box that says "I want to correct my 2020/2019/2018/2017 tax return I already sent to the IRS.

Stride three

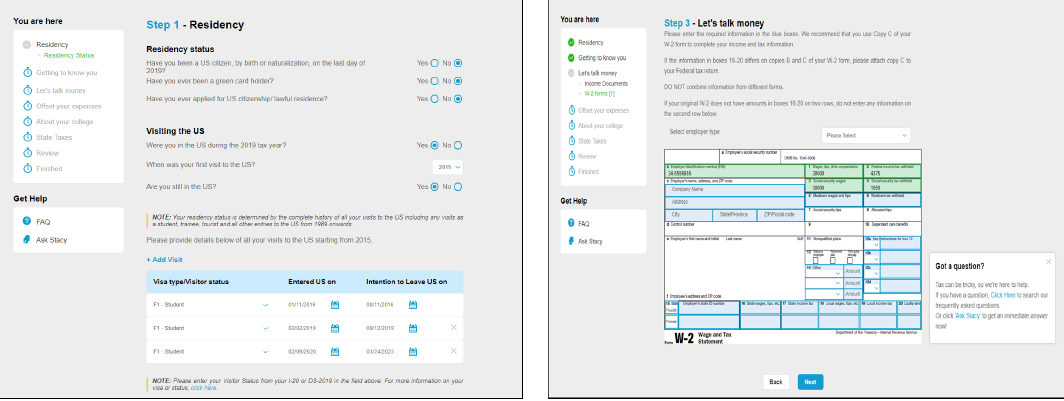

You volition and then demand to complete a questionnaire, where you will be asked for some information including your residency for tax purposes and your income for that specific taxation yr.

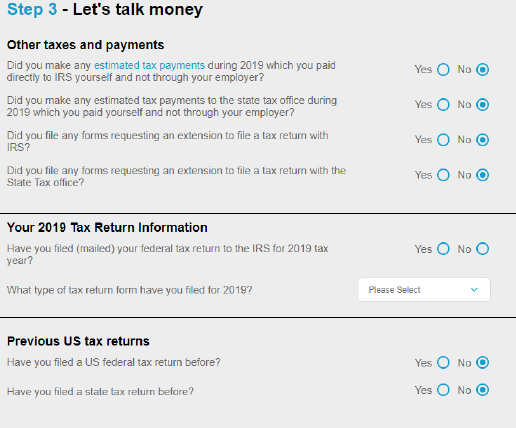

Next, you volition be asked if you filed your return to the IRS for this tax twelvemonth. If the answer is 'yes' you will need to outline what taxation grade you sent.

You will need a copy of your original taxation form in order to complete Step iii.

Stride 4

Once you complete this step y'all volition arrive at the checkout.

Sprintax volition crunch the numbers and prepare your amended tax render which you lot will then need to print, sign and mail to the IRS.

Information technology really is that easy!

And remember, if you take questions near how to amend your taxation return, our Alive Chat team are available 24/7 to back up yous!

Can nonresidents eastward-file an amended revenue enhancement return?

No, you can't file your amended taxation render electronically. Amended returns are only filed on paper.

In one case yous consummate the form, you'll accept to mail it to the IRS along with all the required supporting documents. The normal processing fourth dimension for course 1040X is between eight and 12 weeks from the time the IRS receives your taxation return.

If you are alteration for more 1 taxation year, you will demand to file Form 1040X for each revenue enhancement year separately.

Many people detect the prospect of dealing with the IRS and amending their tax return to exist quite daunting.

If that sounds like you lot,better your US taxation return the like shooting fish in a barrel way with Sprintax!

What Happens Later on You lot Amend Your Tax Render

1. If you are challenge an boosted revenue enhancement refund

If y'all are filing an amended tax render to claim an additional refund, you'll have to wait until you have received your original tax refund before filing a Form 1040X. Amended returns accept upward to 12 weeks to process.

You may cash your original refund cheque while waiting for the boosted refund.

Also, you mostly MUST file the amended return within iii years from the date you filed your original render, or inside two years after the date you paid the tax (whichever is later) in order to get the extra refund.

2. If y'all owe additional taxes

If yous owe boosted taxes, file Form 1040X and pay the taxation as shortly as possible to minimize interest and penalties. If your amended return shows y'all owe more tax than you reported on (and paid with) your original return, yous'll owe boosted interest and probably penalties too.

Even though you might exist amending a return from one or two years agone, the due date for your original return and for payment has already passed. The IRS may non penalize you lot for a pocket-sized mistake, just information technology sure will collect some interest on the proper corporeality you didn't pay on time in the first place. The sooner y'all right the error, the less interest you'll pay.

How long will my amended taxation return accept to process?

According to the IRS, it can have up to sixteen weeks to procedure the 1040x once it is received.

How to check an amended tax render status

The IRSWhere'southward My Amended Return? tool allows you to follow the processing stages of your amended return from receipt until completion.

You can rails if your return is in received, adjusted, or completed status.

How long does it take to get a refund from an amended tax return?

There is no set time that an amended tax refund will take to become to you, so y'all ordinarily just accept to be patient.

Calling the IRS will not speed up the processing of your amended taxation return.

Is amending a tax return a ruddy flag for the IRS?

You may be concerned that amending a revenue enhancement render could trigger a taxation audit.

Thousands of people accept to amend their The states tax returns each year, and then don't worry near whether you'll receive an audit due to your amended tax return.

As long as you lot provide the IRS with the required information on your amended tax return, everything should be fine.

Demand help correcting your nonresident tax render? Fill out grade 1040X easily online with Sprintax!

Started here

Subscribe to the Sprintax Blog!

Usa tax can be confusing. Peculiarly for nonresidents!

That'due south why, if y'all're an International Student or J-ane participant in the US, or you lot work in a University International Student Office, you should subscribe to the Sprintax blog.

Yous'll detect tons of useful content for nonresidents. We cover revenue enhancement, educatee life, acclimatizing to the US and much more than.

So what are you waiting for? Sign up today and never miss a matter!

Hey I'm Stacy! I'm dealing with Usa taxes and can't look to assistance you lot fix your tax return! I've been working with taxes for like forever, and then you can totally trust my expertise. Sprintax can make things much easier for you. Cheque out my web log posts and feel complimentary to ask me any questions.

Source: https://blog.sprintax.com/filed-incorrect-tax-return-how-to-amend/

0 Response to "How Long I Can Log in Again After 3 Tmes Wrong Password With Irs"

Post a Comment